Pre-Hurricane Season Insurance Checklist for Marine Insurers

June 25, 2024

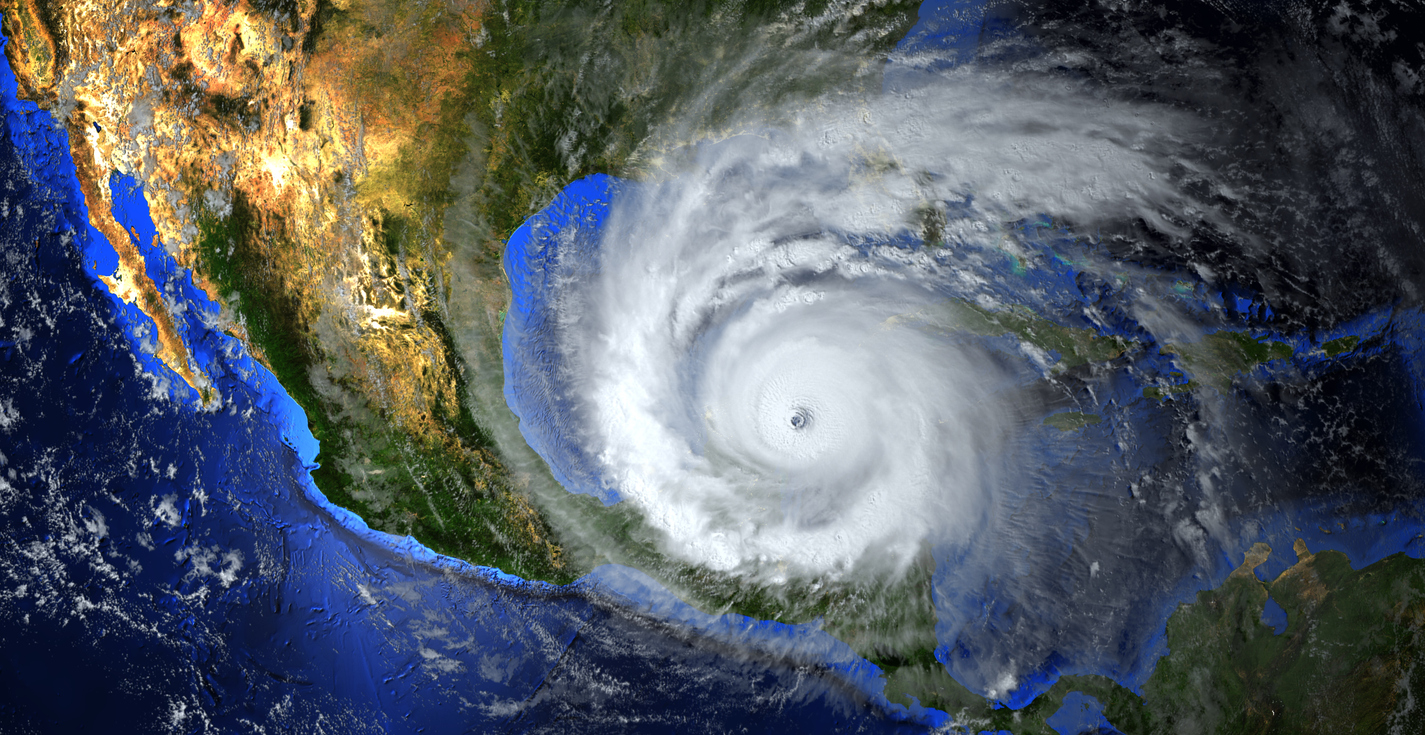

During hurricane season, marinas face significant risks that can impact their operations and assets. Marina operators must have robust marina insurance to mitigate these risks and enjoy comprehensive coverage.

Pre-hurricane season preparation allows marina operators to safeguard their assets and guarantee business continuity. Marina insurance programs help them manage risks associated with hurricanes, providing essential property and liability coverage.

Agents can advise their clients on selecting marina insurance programs that safeguard against potential financial losses and operational disruptions during hurricane season.

Reviewing and Updating Insurance Policies

Reviewing and updating insurance policies is crucial for comprehensive coverage and adequate protection when preparing for hurricanes. Here’s a brief checklist to ascertain the comprehensiveness of current policies:

- Coverage evaluation: Assess if the current policy covers marina assets such as docks, boats, and facilities.

- Policy limits: Verify that policy limits are sufficient to cover potential losses and liabilities.

- Deductibles: Deductibles should be reasonable and manageable in the event of a claim.

- Additional coverage: Additional coverage such as business interruption insurance helps mitigate financial risks from operational disruptions.

- Policy exclusions: Policy exclusions address coverage gaps that may arise during hurricanes or other severe weather events.

Verifying coverage limits and exclusions guarantees adequate protection and avoids potential coverage gaps during hurricane season.

Updating Marina Insurance Programs

Updating policies based on recent claims and experiences improves their relevance and effectiveness. Aligning coverage with current risk assessments optimizes protection against hurricane-related threats and vulnerabilities.

Necessary Endorsements

Necessary endorsements enhance marine insurance policy coverage, safeguarding policyholders against specific risks.

Recommended Endorsements for Hurricane Coverage

Business interruption insurance helps mitigate financial losses from operational disruptions caused by severe weather. Flood insurance covers damages inflicted by hurricanes and protects against flooding-related risks.

Enhancing Liability and Property Coverage

Comprehensive liability protection safeguards marina operators against potential legal and financial risks. Reviewing property coverage safeguards them against damages and losses during hurricane season.

Facility and Equipment Inspections

Preparing a checklist for physical inspections helps enhance readiness and resilience against potential storm damage. Key areas to inspect include:

- Docks

- Pilings

- Moorings

Marina operators should identify vulnerabilities such as loose fittings or corroded components. They should also secure loose items and reinforce vulnerable areas.

Assessing Risk and Taking Preventive Measures

Regular maintenance and inspections are crucial for the longevity and safety of marine assets during hurricane season. Here are steps to mitigate identified risks:

- Determine structural integrity: Regular inspections help identify structural weaknesses.

- Secure loose items: Securing loose items prevents them from becoming projectiles during high winds.

- Practice flood prevention: Installing flood barriers or pumps protects vulnerable areas from water ingress.

- Prepare for emergencies: Emergency plans should include procedures for securing vessels, evacuating personnel, and promptly responding to storm impacts.

Equipment and Vessel Assessments

Safe storage and mooring protects boats and other assets during hurricane season. Here’s a checklist for securing boats and other assets:

- Secure location: Secure storage or mooring locations such as hurricane-rated marinas or inland areas can protect equipment from storm surges.

- Strong mooring lines: Strong and properly sized mooring lines secure boats to docks or mooring buoys, enabling them to withstand strong winds and waves.

- Remove electronics and valuables: Removing valuable electronics and personal items from the boat can prevent damage or theft.

- Double-check cleats and fittings: Securing cleats, fittings, and hardware prevents them from failing during high winds.

- Cover and secure: Tarps and boat covers protect vessels from wind, rain, and debris.

- Inspect and maintain: Regular inspections help identify signs of wear or damage so vessels can be maintained if necessary.

Preparing for Potential Storm Damage

Insurance agents should advise marina clients to secure loose items, conduct regular inspections, and install flood protection measures to minimize equipment and infrastructure damage. Stress the importance of having a detailed emergency plan.

Emergency Preparedness Plans

Marina operators should establish clear communication strategies and maintain updated emergency contacts to facilitate swift responses during hurricanes. They should also develop detailed action plans tailored to various hurricane scenarios.

Tailoring Plans to Specific Marina Needs

Marina operators should customize emergency plans based on factors such as marina size, location, and client base to address specific needs and vulnerabilities. They should brief all staff and clients to facilitate prompt and coordinated responses.

Training Staff and Clients

Marina operators should conduct regular training sessions and drills to prepare staff for emergency procedures. All personnel should be familiar with these procedures.

Educating Clients on Hurricane Preparedness

Insurance agents can support marina operators by providing resources, guides, and informational materials to help clients understand and navigate insurance coverage options. Workshops or webinars can further educate clients on risk management strategies and preparedness measures.

Client Communication and Education

Insurance agents can leverage technology to provide their clients with real-time updates and alerts about weather conditions and potential risks. They should emphasize timely communication to enable clients to protect their assets and personnel effectively.

Proactive Communication Strategies

Insurance agents can set up automated alert systems to provide their clients with timely notifications about weather updates and potential risks. This proactive approach helps clients stay informed and prepared to protect their assets and operations.

Preparing for the Unexpected with Marina Insurance

Pre-hurricane season preparation enhances marina operators’ readiness to mitigate risks and protect assets. Marina insurance programs can safeguard against potential damages and losses caused by severe weather events, offering essential coverage.

For expert guidance and comprehensive coverage solutions, contact Merrimac Marine Insurance today to secure peace of mind before hurricane season arrives.

About Merrimac Marine Insurance

At Merrimac Marine, we are dedicated to providing insurance for the marine industry to protect your clients’ businesses and assets. For more information about our products and programs, contact our specialists today at (800) 681-1998.