Charting a Smooth

Course for Recreational

and Commercial Marine

Insurance

Find out more about our insurance programs.

Our Insurance ProgramsA

Merrimac Marine: The Marine Insurance Experts

For over 35 years, Merrimac Marine Insurance has been a beacon for the recreational marine insurance industry, providing the expertise and experience required to assist the various segments that make up this market in mitigating and transferring risk. When your agency partners with Merrimac, you will be working with seasoned professionals delivering a comprehensive insurance program with broad coverage forms, consultative loss control, and proactive claims management along with exceptional customer service to ensure that your clients’ needs are being served. Your clients can be assured that we will be there with them in the event of a claim.

Our mutual goal with our agency partners is to help you obtain and keep your clients year after year through solid insurance protection and responsive service.

We work with more than 15 top-tier admitted and non-admitted insurers in the insurance market backed by stability and financial strength to secure the coverages that will address the various exposures recreational marine and commercial marine insurance customers face. From losses due to natural catastrophes, fire, and other hazards, to accidents and injuries to product liability claims, and errors or omissions in providing professional services, Merrimac will assist you in getting your insureds covered.

Marine Insurance Policies

We provide critical coverages for the recreational marine and commercial or light marine industries to protect against financial losses in the event of an incident or accident. We offer a portfolio of optional coverages, as well.

Liability coverage to help transfer risk for business operations

General Liability, Product Liability, Protection and Indemnity, Marine Liability/Operators Legal Liability, Professional Liability, and others.

Property coverage to cover businesses against physical damage and other risks

Real and Personal Property, Yacht Dealer, Equipment & Tools, Business Income, and others.

Inland Marine insurance

Equipment floater, Installation floater. and others.

Employee coverage

Workers’ Compensation and Jones Act/MEL/USL&H, United States Longshore and Harbor Workers Act (we understand the law with regard to providing coverage for workers on land and on or near the sea).

Our Specialties

Merrimac specializes in providing insurance solutions to key marine industry segments:

- Boat Dealers

- Marinas & Yacht Clubs

- Personal Watercraft/Pleasure Craft Rentals

- Boat & Yacht Builders

- Shipping Industry/Ship Repairers

- Marine Manufacturers

- Manufacturing: Parts & Accessories

- Commercial Marine

- Marine Contractors (construction projects involving port authorities, bridges, docks, dredgers, seawalls)

- Marine Repairers

- Marine Surveyors

- USL&H

- Marine Employee Liability (MEL)

- Protection & Indemnity (P&H) Crew Seaman

Blog

For three decades Merrimac Marine Insurance has been a beacon for the recreational marine insurance industry by providing the expertise and experience required to assist the various segments that make up this market in mitigating and transferring risk.

Why It’s Important to Maintain a Boat

It's important to maintain a boat to prevent any recurring issues from happening to the vessel over...

Understanding Liability for Piers, Wharves & Docks: Risks in Boat Dealer Operations

The boating industry is riding a wave of growth, fueled by rising demand for recreational watercraft and...

Yacht Clubs and Cybersecurity: Protecting Member Data in the Digital Age

Yacht club insurance has evolved with the increasing reliance on digital systems and data storage within the...

Why Recreational Marine Insurance Matters for Winter Storage Risks

Recreational marine insurance may not fully cover the risks associated with storing vessels during the winter months....

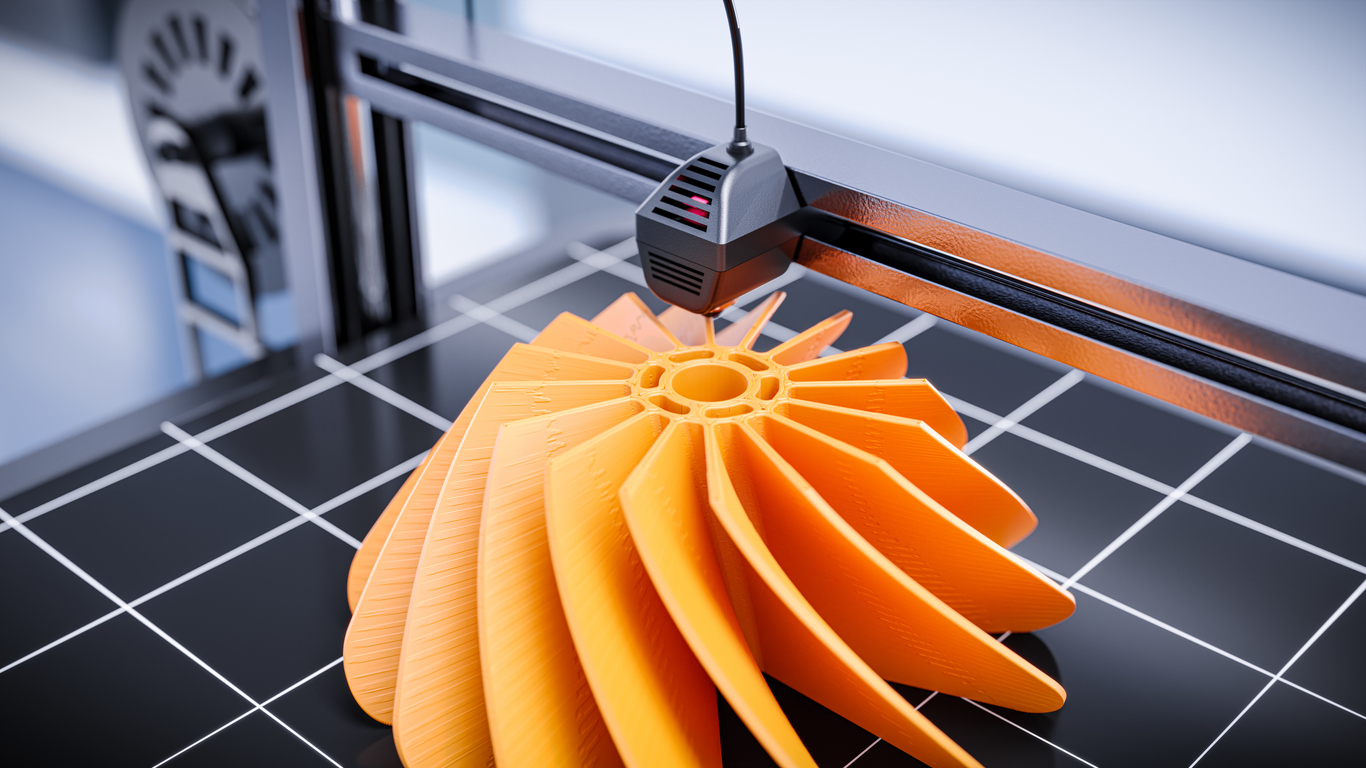

The Impact of 3D Printing on Boat Building and Its Insurance Considerations

As boat builder insurance evolves with technological advancements, the growing impact of 3D printing is reshaping the...

How Personal Watercraft Rental Insurance Is Adapting to the Popularity of Electric PWCs

The watercraft rental industry has experienced a rapid evolution, particularly with the growing demand for electric personal...

Marine Insurance Is What We Do, All Day, Every Day

Our focus is on the recreational and commercial marine industries, with our clients ranging from middle-market to large global companies within the specialized marine industry. We are available to assist agents in safeguarding your clients against risk and expanding your footprint in this market. We can help your review your clients’ and prospective businesses’ existing coverages and each insurance policy to assess if their insurance program properly addresses their risks. Our specialists will also review their cost of their program to determine if we could save your clients money. Give us a call at 800.681.1998 or complete the form on this page for more information.